Welcome To Saphalaya Investment Capital

Saphalya investment capital is an online/offline real estate investment platform unlocking access to institutional grade real estate for the retail investor.With our focus on technology and the team’s expertise in investment management, we offer curated high yield investments over the entire real estate capital stack, from Commercial real estate (CRE) ownership to high yield debentures.

Each investment is sourced and screened by us and is secured by underlying real estate across office, warehousing, co-living, co-working and residential properties.

Our Mission

Our Mission is to provide the retail investor with unparalleled access to institutional quality investments backed by a simple & seamless digital investing experience enabling them to easily own, invest and manage high yield private real estate including Commercial real estate.

Our Vision

To be a leading tech focused online investing platform and a partner of choice for the retail investor to invest in real estate based on trust, transparency and consistent track record of delivering superior returns. We are committed to empowering the retail investor to build wealth in high yield private real estate, a segment historically only accessible to institutions, family offices and high net worth individuals.

Why With Saphalya Investment Capital?

Investing in real estate through our platform offers several advantages:

1.Expertise: We have a team of experienced professionals who carefully select properties and manage investments, ensuring that our investors have access to high-quality real estate opportunities.

2.Diversification: Our platform provides access to a diversified portfolio of properties across different locations and types, allowing investors to spread their risk and maximize potential returns.

3.Transparency: We prioritize transparency in all our dealings, providing investors with clear information about each property, its financial performance, and the investment process.

4.Accessibility: Our platform makes real estate investing accessible to a wider range of individuals by lowering the barrier to entry with fractional ownership options and lower capital requirements.

5.Flexibility: We offer flexibility in investment options, allowing investors to choose properties that align with their investment goals and risk tolerance. Additionally, we may provide liquidity options, allowing investors to exit their investments when needed.

6.Support: Our dedicated support team is available to assist investors throughout the investment process, from initial inquiries to ongoing support and updates.

Overall, investing with us provides a convenient and reliable way for individuals to participate in real estate markets and benefit from the potential returns of property ownership with the support of an experienced team and a transparent, accessible platform.

Fractional investment in real estate is a strategy where multiple investors pool their resources to collectively invest in a property. Each investor owns a fraction or share of the property, which can range from a small percentage to a larger portion depending on the investment structure. This allows individuals to access real estate investments with lower capital requirements and diversify their portfolios across multiple properties.

Overall, fractional investment in real estate provides a convenient and accessible way for individuals to participate in real estate markets and benefit from the potential returns of property ownership without the need for significant capital or active management involvement.

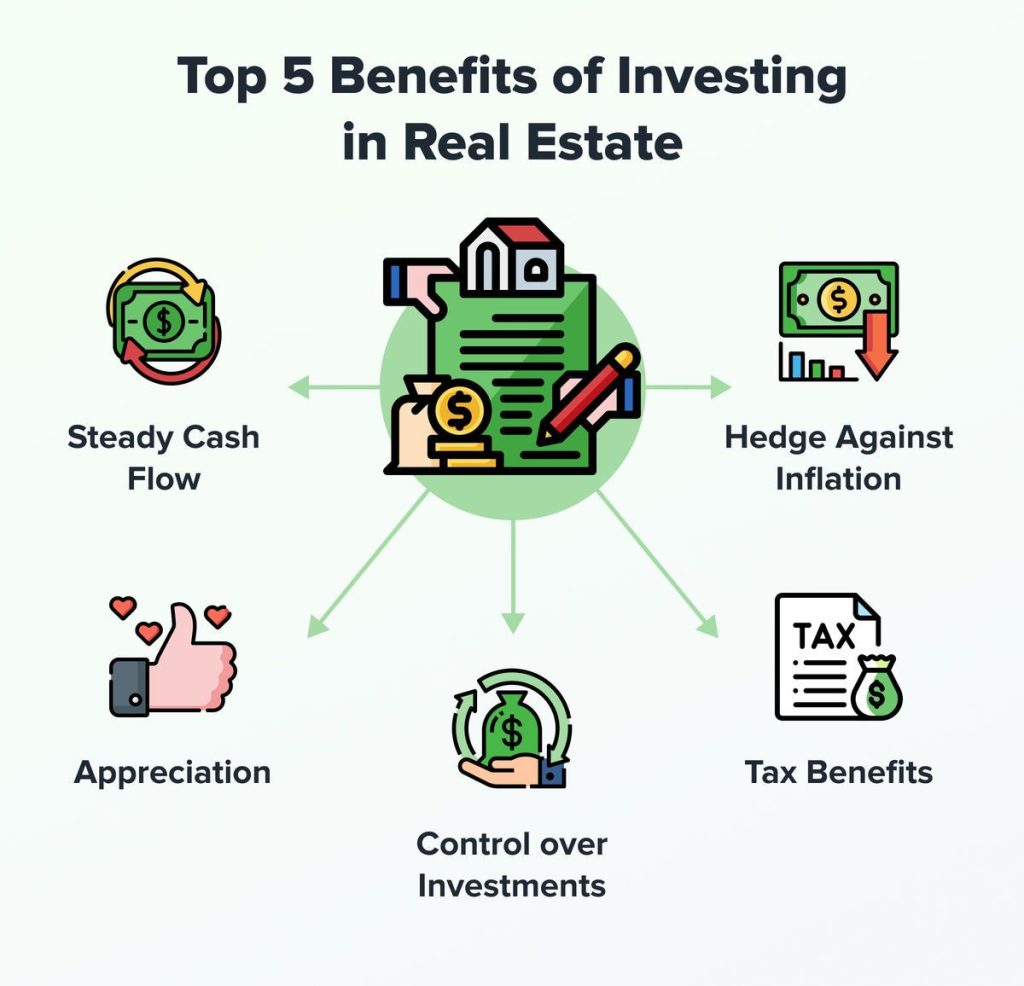

Why Real state?

High returns

Private real estate investments offer attractive double digit annualized returns.

Consistent income & growth

Commercial real estate generates monthly rental income with growth through capital appreciation.

Tangible asset

Real estate due to its use case nature has significant intrinsic value and offers principal protection.

Low volatility

Real estate is uncorrelated to public markets offering excellent diversification benefits to equities.